The NFT market is constantly evolving, and 2025 promises to be a pivotal year. This article explores the top 5 NFT trends poised to dominate the landscape next year, including significant advancements in metaverse integration, the rise of NFT utility and fractionalization, the burgeoning space of AI-generated NFTs, the increasing importance of community and IP rights within NFT projects, and the expansion into new Web3 applications. Prepare to navigate the future of digital ownership and discover the NFT investment opportunities that await.

NFTs in Gaming and Virtual Worlds

The intersection of Non-Fungible Tokens (NFTs) and the gaming/virtual world industries presents a rapidly evolving landscape with significant implications for both players and developers. The core concept revolves around using NFTs to represent unique in-game assets, offering players true ownership and enabling new economic models.

One key application is the creation of unique digital items. These could range from cosmetic skins for characters to powerful weapons and tools, all verifiable on a blockchain. This contrasts with traditional games where items are often tied to a specific account and are not easily transferable or tradable.

The use of NFTs fosters a player-driven economy. Players can buy, sell, and trade these digital assets, creating a secondary market independent of the game developers. This opens up new revenue streams for players and potentially allows for greater community involvement in shaping the game’s ecosystem.

However, several challenges and criticisms surround the implementation of NFTs in gaming. Concerns exist regarding the environmental impact of blockchain technology, the potential for scams and fraud, and the accessibility of NFTs for all players due to the cost of entry. Furthermore, the value of in-game NFTs can fluctuate significantly, introducing risk for both buyers and sellers.

The future of NFTs in gaming is likely to be shaped by technological advancements that address existing concerns. The development of more energy-efficient blockchains and improved regulatory frameworks are crucial for mainstream adoption. The success of NFTs in this space will largely depend on developers creating compelling use cases that offer genuine value to players beyond mere speculation.

Ultimately, the integration of NFTs in gaming and virtual worlds represents a paradigm shift in how games are designed, monetized, and experienced. While challenges remain, the potential for increased player ownership, new economic models, and enhanced community engagement makes it a space worth continued observation and analysis.

Fractionalized NFTs for Shared Ownership

Fractionalized NFTs represent a novel approach to digital asset ownership, enabling the division of a single Non-Fungible Token (NFT) into smaller, transferable units called fractions or shares. This process allows multiple individuals to collectively own a valuable NFT, such as a prized piece of digital art or a coveted virtual real estate property, despite its indivisible nature.

This innovative mechanism unlocks several key benefits. Firstly, it significantly reduces the barrier to entry for acquiring high-value NFTs. Instead of needing the full purchase price, individuals can invest smaller amounts to gain partial ownership. This democratizes access to a market previously dominated by high-net-worth individuals. Secondly, fractionalization enhances liquidity. Owners of fractional shares can easily buy, sell, or trade their portions, leading to increased market activity and a more dynamic NFT ecosystem.

However, implementing fractionalized NFTs effectively requires careful consideration of several technical and legal challenges. Establishing a robust and transparent system for managing fractional ownership rights is paramount. This includes clear definitions of each share’s value, voting rights, and distribution of potential future profits or royalties. Furthermore, addressing regulatory concerns related to securities law and ensuring the secure and immutable recording of ownership changes are crucial aspects to resolve.

The future of fractionalized NFTs appears bright, promising a more inclusive and liquid market for digital assets. As the technology matures and regulatory frameworks develop, we can anticipate widespread adoption across various sectors, potentially revolutionizing how we think about and interact with digital ownership. The implications extend beyond art and virtual real estate, impacting areas such as collectibles, gaming assets, and even intellectual property rights.

Nevertheless, risks and potential drawbacks must be acknowledged. These include the complexities of managing fractional ownership, the potential for disputes over governance, and vulnerabilities to fraud and scams. Thorough due diligence and a comprehensive understanding of the underlying technology and legal implications are vital before participating in fractionalized NFT markets.

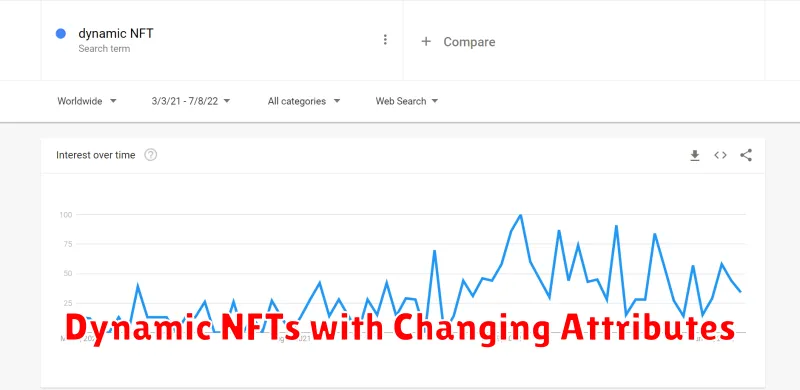

Dynamic NFTs with Changing Attributes

Dynamic NFTs represent a significant evolution in the non-fungible token landscape. Unlike static NFTs, which maintain a consistent appearance and attributes post-mint, dynamic NFTs possess the capacity to evolve and change over time. This transformative characteristic opens up exciting new possibilities for creators and collectors alike.

The core functionality of a dynamic NFT hinges on its programmability. Smart contracts embedded within the NFT govern its attributes, allowing for modifications triggered by various events or conditions. These changes could encompass alterations to the visual representation, metadata, utility, or even access rights associated with the NFT.

One of the most compelling applications of dynamic NFTs lies in the realm of gaming. Imagine an in-game NFT representing a character that levels up and visually transforms based on gameplay achievements. Or consider an NFT representing a virtual asset that increases in value depending on real-world events or market fluctuations.

The creative potential of dynamic NFTs is immense. Artists can create NFTs that age and weather over time, reflecting the passage of time or specific environmental conditions. This dynamic approach imbues NFTs with a sense of storytelling and uniqueness that surpasses their static counterparts.

However, the development and implementation of dynamic NFTs also present certain challenges. The complexity of smart contract programming requires a high degree of technical expertise. Furthermore, ensuring the security and immutability of the NFT’s attributes throughout its evolution remains a critical consideration.

Despite these challenges, the ongoing innovation in the field points towards a future where dynamic NFTs become increasingly prevalent. Their capacity to adapt and change offers a unique level of engagement and value that is redefining the possibilities of the NFT ecosystem. The flexibility inherent in dynamic NFTs is poised to unlock new levels of creativity and utility in numerous applications.

NFT Staking for Passive Income

NFT staking has emerged as a popular method for generating passive income within the burgeoning cryptocurrency and non-fungible token (NFT) markets. This process involves locking up, or “staking,” your NFTs in a designated platform or smart contract to earn rewards. These rewards can take many forms, including more NFTs, cryptocurrency, or other in-game assets, depending on the specific platform and its offerings.

The mechanics of NFT staking vary depending on the project. Some platforms utilize a proof-of-stake (PoS) consensus mechanism, where users’ staked NFTs are used to validate transactions and secure the blockchain network. In return for providing this service, stakers receive rewards proportional to their contribution. Other platforms may offer staking as a means of participating in governance decisions within the NFT ecosystem or to access exclusive content and opportunities.

Before engaging in NFT staking, it’s crucial to conduct thorough due diligence. Research the platform’s reputation, security measures, and the terms and conditions governing the staking process. Assess the risks involved, including the potential loss of your staked NFTs due to platform vulnerabilities or smart contract exploits. Consider the Annual Percentage Yield (APY) offered and compare it to other investment opportunities to determine if the returns justify the risks.

The liquidity of staked NFTs is another critical factor. Some platforms impose lock-up periods, preventing you from accessing your NFTs for a specified duration. This should be carefully considered before committing your assets. Furthermore, the value of the rewards earned through staking can fluctuate based on market conditions, impacting the overall profitability of the venture.

In conclusion, NFT staking offers a promising avenue for passive income generation, but it’s essential to approach it with caution and a comprehensive understanding of the associated risks and rewards. Proper research and a prudent investment strategy are crucial for mitigating potential losses and maximizing returns.

Mainstream Adoption of NFT Tickets and Memberships

The mainstream adoption of Non-Fungible Tokens (NFTs) for tickets and memberships is rapidly accelerating. Initially perceived as a niche technology, NFTs are now being embraced by a wider audience, driven by several key factors.

One significant driver is the enhanced security and authenticity offered by NFTs. Unlike traditional paper tickets, NFTs are virtually impossible to counterfeit, significantly reducing fraud and the risk of scalping. This provides a more secure and reliable experience for both event organizers and attendees.

Furthermore, the unique features of NFTs allow for innovative engagement opportunities. NFTs can unlock exclusive content, access to VIP experiences, and community benefits, creating a more valuable and personalized experience for holders. This fosters a stronger connection between organizations and their members or fans.

The growing ease of use is also playing a crucial role. Platforms are continually improving the user experience, making it easier for individuals to purchase, manage, and utilize NFT tickets and memberships, regardless of their technical expertise.

Scalability and interoperability are important considerations for widespread adoption. As blockchain technology continues to evolve and improve, the efficiency and cost-effectiveness of managing large numbers of NFTs are increasing, making it more feasible for large-scale events and organizations.

However, challenges remain. Education and awareness are still crucial, as many individuals are unfamiliar with NFT technology. Addressing concerns around environmental impact, associated with the energy consumption of some blockchains, is also vital for sustainable growth.

Despite these challenges, the future of NFT tickets and memberships appears bright. The benefits of increased security, enhanced engagement, and innovative features outweigh the limitations, suggesting a continued rise in mainstream adoption in the years to come.