Navigating the dynamic world of cryptocurrency requires careful planning and informed decision-making. This article outlines 5 essential crypto investment tips for 2025, designed to help you navigate the potential risks and rewards. We’ll explore strategies for diversifying your portfolio, understanding market volatility, managing risk effectively, and researching promising cryptocurrencies for long-term growth. Learn how to develop a robust crypto investment strategy and make informed choices in the ever-evolving landscape of digital assets.

Diversify Your Crypto Portfolio

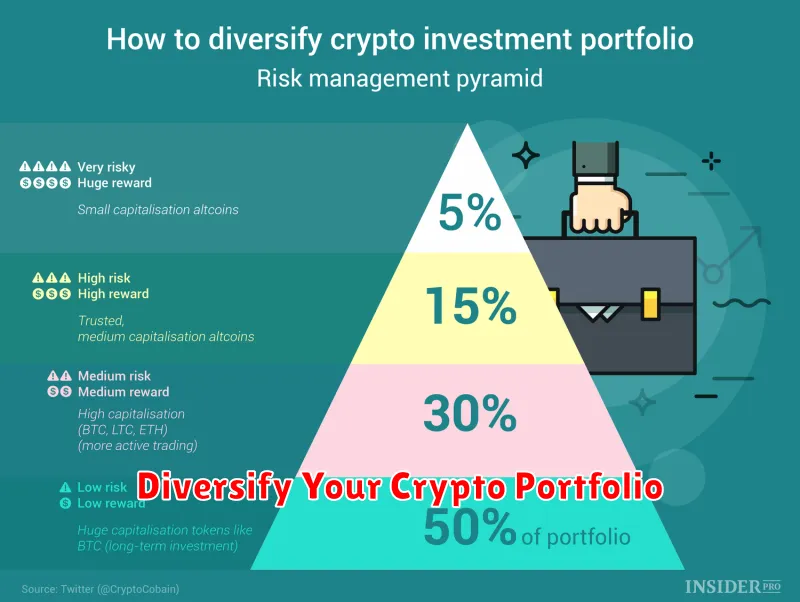

Diversification is a crucial strategy for mitigating risk in any investment portfolio, and the cryptocurrency market is no exception. Cryptocurrencies are known for their volatility, meaning prices can fluctuate dramatically in short periods. Therefore, a diversified portfolio, spread across various assets, can help cushion the impact of losses in any single investment.

A well-diversified portfolio should include a range of cryptocurrencies with varying market capitalizations, functionalities, and levels of risk. Including both large-cap and small-cap assets can provide a balanced approach. Large-cap cryptocurrencies, like Bitcoin and Ethereum, generally exhibit lower volatility, whereas smaller-cap assets may offer higher potential returns but with increased risk.

Beyond simply diversifying across different cryptocurrencies, investors should also consider diversifying into related assets such as DeFi tokens, NFT’s (Non-Fungible Tokens), and stablecoins. This approach further reduces overall portfolio risk by spreading investments across different segments of the crypto market.

Careful research is essential before adding any new asset to your portfolio. Understanding the technology, the project’s team, and the overall market conditions is paramount. Relying solely on hype or short-term price movements can lead to poor investment decisions.

Finally, remember that diversification is not a guarantee against losses. Even a well-diversified portfolio can still experience negative returns. Risk tolerance should be carefully considered when building your portfolio and adjusted according to your individual circumstances and financial goals. It is advisable to consult with a qualified financial advisor before making any significant investment decisions.

Invest in Blue-Chip Cryptos

Investing in cryptocurrency can be a risky venture, but diversifying your portfolio with blue-chip cryptos can mitigate some of that risk. Blue-chip cryptos are established cryptocurrencies with a proven track record of stability and market capitalization. These are generally considered less volatile than newer, less established altcoins.

Bitcoin (BTC) and Ethereum (ETH) are prime examples of blue-chip cryptocurrencies. They boast large market caps, extensive adoption, and significant technological advancements. Their relatively long history in the cryptocurrency market compared to newer coins provides investors with a greater sense of confidence and stability.

Investing in blue-chip cryptos doesn’t eliminate risk entirely. The cryptocurrency market is still inherently volatile, and even established coins can experience price fluctuations. However, the lower volatility associated with these assets compared to newer, less-established coins makes them a comparatively safer option for risk-averse investors.

Before investing in any cryptocurrency, it’s crucial to conduct thorough research and understand the associated risks. Consult with a qualified financial advisor to determine if cryptocurrency investments align with your overall financial goals and risk tolerance. Remember that past performance is not indicative of future results.

Diversification is key to any successful investment strategy, and this principle applies to cryptocurrency investments as well. Don’t put all your eggs in one basket; spread your investments across multiple blue-chip cryptos to further reduce risk. Consider your personal financial situation and investment timeline before making any decisions.

Ultimately, investing in blue-chip cryptos offers a potentially rewarding strategy for those seeking a balance between risk and reward in the cryptocurrency market. However, it remains imperative to approach such investments with caution and a well-informed understanding of the market dynamics.

Understand Market Cycles

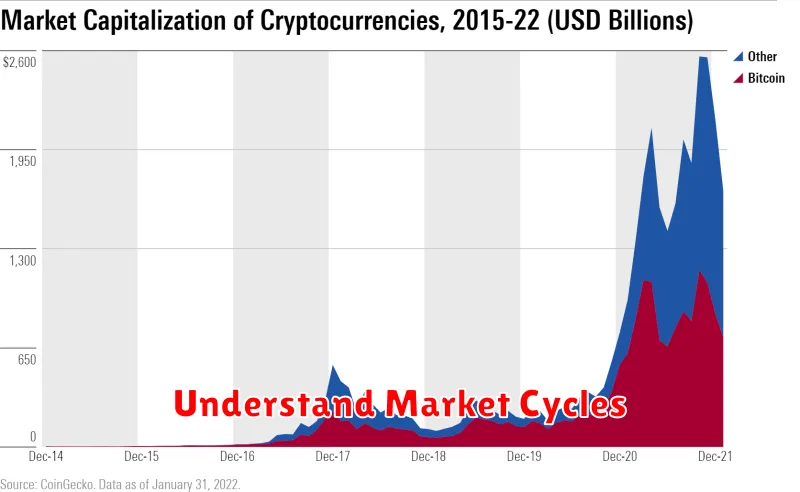

Understanding market cycles is crucial for investors of all levels. These cyclical fluctuations, characterized by periods of growth and decline, are inherent to the nature of financial markets. Ignoring these cycles can lead to poor investment decisions and potentially significant losses.

A typical market cycle involves several phases. The expansion phase is characterized by strong economic growth, rising asset prices, and increasing investor confidence. This period often sees high levels of employment and consumer spending. However, this expansion doesn’t last indefinitely.

The peak marks the end of the expansion phase. At this point, asset prices are at their highest point before a downturn begins. Often, signs of economic overheating, such as inflation, become apparent. This is a critical juncture for investors to consider adjusting their portfolios.

Following the peak is the contraction phase, also known as a recession or bear market. During this period, economic activity slows down, asset prices fall, and investor sentiment turns negative. Job losses may occur, and consumer spending decreases. This phase can be particularly challenging for investors, requiring careful risk management.

Finally, the cycle reaches its trough, representing the lowest point of the contraction phase. From here, the market begins to recover, gradually entering a new expansionary phase. This is often an attractive opportunity for long-term investors to enter the market but requires careful analysis to determine a true trough.

While identifying the exact timing of these phases is impossible, understanding the characteristics of each stage allows investors to make more informed decisions. Diversification, risk management, and a long-term perspective are essential strategies for navigating market cycles effectively.

It’s important to note that market cycles vary in length and intensity. Some cycles are short and mild, while others can be prolonged and severe. Therefore, a thorough understanding of economic indicators, historical market data, and various investment strategies is vital for successful investing.

Ultimately, mastering the art of understanding and responding to market cycles is a continuous learning process that requires both knowledge and discipline. Patience and adaptability are key attributes for navigating the unpredictable nature of financial markets.

Use Dollar-Cost Averaging (DCA)

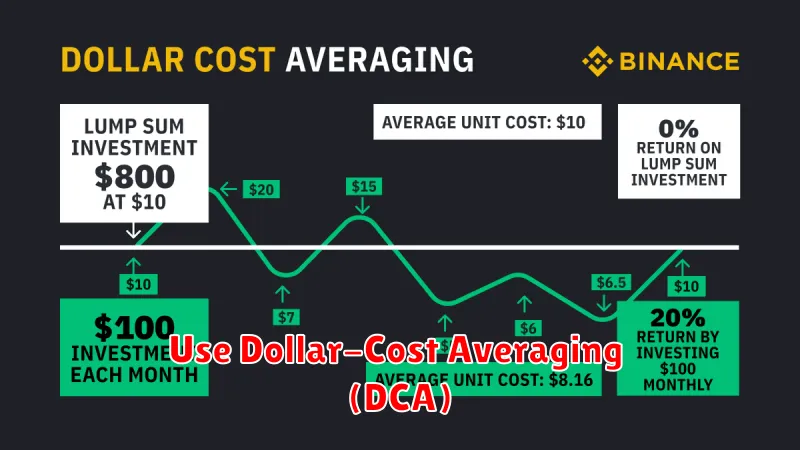

Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s fluctuations. This approach mitigates the risk of investing a lump sum at a market high, a common pitfall for many investors. By consistently investing, you buy more shares when prices are low and fewer when prices are high, potentially lowering your average cost per share over time.

Advantages of DCA include reduced emotional decision-making, as the investor doesn’t need to time the market. It also promotes discipline and consistency in investing. The strategy is relatively simple to implement and understand, making it accessible to investors of all experience levels. However, it’s crucial to note that DCA doesn’t guarantee profits and may not always outperform a lump-sum investment, particularly in consistently rising markets.

Disadvantages primarily revolve around the potential for missing out on significant gains during periods of rapid market growth. A lump-sum investment would benefit more from such periods. Additionally, DCA requires a longer-term perspective, and the investor needs to be committed to the strategy for an extended timeframe to realize its potential benefits. Transaction fees associated with regular investments can also negatively impact returns, although this is less significant with many brokerages offering commission-free trades.

Implementation is straightforward. An investor decides on a fixed amount and a regular interval (e.g., $500 per month). This amount is then invested automatically, regardless of market conditions. Various investment platforms offer automated DCA features, simplifying the process significantly. It’s important to select investments aligned with your risk tolerance and long-term financial goals before employing this strategy.

In conclusion, dollar-cost averaging is a viable investment strategy, particularly for risk-averse investors who prioritize consistency over attempting to time the market. While it doesn’t guarantee superior returns, it offers a disciplined approach to investing that can potentially mitigate risk and provide long-term growth.

Avoid Hype and Pump-and-Dump Schemes

Investing in the cryptocurrency market can be incredibly lucrative, but it’s also fraught with risk. One significant danger to be aware of is the prevalence of hype and pump-and-dump schemes.

These schemes often involve coordinated efforts to artificially inflate the price of a relatively unknown cryptocurrency. Social media and online forums are frequently used to generate excitement and create a false sense of demand. This leads to a rapid price increase, allowing early participants (those involved in the scheme) to sell their holdings at a significant profit.

Once the price has peaked, the artificial support collapses, and the price plummets. Those who bought in based on the hype are left holding a worthless or significantly devalued asset, suffering substantial financial losses. This leaves many investors feeling disillusioned and betrayed.

Identifying pump-and-dump schemes can be challenging, but there are some warning signs to watch out for. Sudden and dramatic price increases with no apparent underlying fundamentals are a major red flag. Excessive social media promotion, often involving coordinated messaging or anonymous accounts, should also raise suspicion. A lack of transparency about the project or its team is another significant concern.

Thorough due diligence is essential before investing in any cryptocurrency. Research the project’s whitepaper, understand the technology behind it, and look for independent analysis and reviews. Be wary of promises of unrealistic returns and avoid investing based solely on hype or social media buzz.

Ultimately, a cautious and informed approach is crucial. Only invest what you can afford to lose, and diversify your portfolio to mitigate risk. Remember, if something seems too good to be true, it probably is. Protect yourself from these schemes by conducting thorough research and maintaining a healthy level of skepticism.