Navigating the volatile world of cryptocurrency requires a strategic approach. This article outlines the top 5 cryptocurrency investment strategies for 2025, designed to help you maximize returns and mitigate risk. We’ll explore effective methods including dollar-cost averaging, diversification across various cryptocurrencies and market caps, leveraging blockchain technology analysis, and understanding the impact of regulatory changes on your crypto portfolio. Prepare to equip yourself with the knowledge to make informed decisions in the ever-evolving landscape of cryptocurrency investment in the coming years.

Long-Term Holding (HODL)

Long-term holding, often abbreviated as HODL (a deliberate misspelling of “hold” originating from a Bitcoin forum post), is an investment strategy characterized by purchasing and holding assets, such as stocks or cryptocurrencies, for an extended period, typically years or even decades, regardless of short-term market fluctuations.

The core principle behind HODLing is the belief in the long-term growth potential of the chosen assets. HODLers are typically less concerned with daily price movements and focus instead on the fundamental value and potential future appreciation of their investments. This strategy aims to mitigate the impact of short-term volatility and capitalize on the power of compound growth.

Advantages of HODLing include reduced trading fees, avoidance of impulsive decisions driven by market sentiment, and the potential for significant returns over the long term. However, it’s crucial to acknowledge the inherent risks involved. The value of held assets could decline significantly over the holding period, resulting in potential losses. Furthermore, unforeseen events or changes in market conditions could negatively impact the long-term performance of the investment.

Successful HODLing requires thorough research and a well-defined investment strategy. It’s essential to choose assets based on fundamental analysis, risk tolerance, and long-term financial goals. Diversification across different asset classes can also help to mitigate risk. Emotional discipline and a long-term perspective are paramount to effectively employing this strategy.

In summary, HODLing is a viable investment strategy for those with a long-term horizon, a high risk tolerance, and the discipline to weather short-term market volatility. However, it’s imperative to conduct thorough due diligence, understand the associated risks, and develop a comprehensive investment plan before adopting this approach.

Day Trading for Short-Term Gains

Day trading, a practice involving buying and selling financial instruments within the same trading day, presents significant opportunities for short-term gains. However, it also carries considerable risk.

Successful day trading hinges on a deep understanding of market dynamics, technical analysis, and risk management. Traders must be adept at interpreting charts, identifying trends, and executing trades swiftly and decisively. Discipline and emotional control are paramount, as impulsive decisions can quickly lead to substantial losses.

Technical indicators and chart patterns are frequently employed to identify potential trading opportunities. Popular tools include moving averages, relative strength index (RSI), and candlestick patterns. Analyzing these indicators helps traders anticipate price movements and time their entries and exits effectively. However, it’s crucial to remember that these are not foolproof; they should be used in conjunction with broader market analysis.

Risk management is arguably the most crucial aspect of day trading. Employing strategies like stop-loss orders to limit potential losses is essential. Diversifying investments across different assets can further mitigate risk. Furthermore, position sizing, carefully determining the amount invested in each trade relative to one’s overall capital, prevents catastrophic losses from wiping out an account.

While the potential for quick profits is alluring, aspiring day traders should approach this endeavor with realistic expectations and a thorough understanding of the inherent risks. Consistent profitability requires extensive knowledge, diligent preparation, and the ability to adapt to constantly evolving market conditions. Thorough education and practice, possibly through simulation trading, are crucial before committing real capital.

Ultimately, successful day trading is a blend of skill, discipline, and risk management. While potential rewards are substantial, the inherent volatility demands a cautious and informed approach. It is not a path to riches overnight; rather, it requires dedication, study, and a deep understanding of the markets.

Staking and Passive Income

Staking is a process that allows cryptocurrency holders to lock up their tokens for a certain period to support the security and operations of a blockchain network. In return for this contribution, stakers receive rewards in the form of newly minted cryptocurrency or transaction fees. This creates a potential stream of passive income.

The mechanics of staking vary depending on the specific cryptocurrency and its consensus mechanism. Some networks utilize a proof-of-stake (PoS) system, where validators are chosen based on the amount of cryptocurrency they stake. Others use variations like delegated proof-of-stake (DPoS), allowing users to delegate their staking power to a chosen validator.

The rewards generated through staking can vary significantly. Factors influencing the reward rate include the total amount staked, the network’s inflation rate, and the demand for staking services. It’s crucial to research these factors thoroughly before committing to any staking program.

While staking offers the potential for passive income, it is not without risks. These risks include the potential for loss of principal in cases of network failures or security breaches, as well as volatility in the value of the staked cryptocurrency. Furthermore, unstaking, the process of retrieving your staked tokens, may involve lock-up periods or other restrictions.

Before engaging in staking, it’s essential to conduct thorough research on the specific cryptocurrency and the staking platform. Understanding the associated risks and potential rewards is critical for making informed investment decisions. Consider factors like the security of the platform, the reputation of the project, and the potential returns before committing your funds.

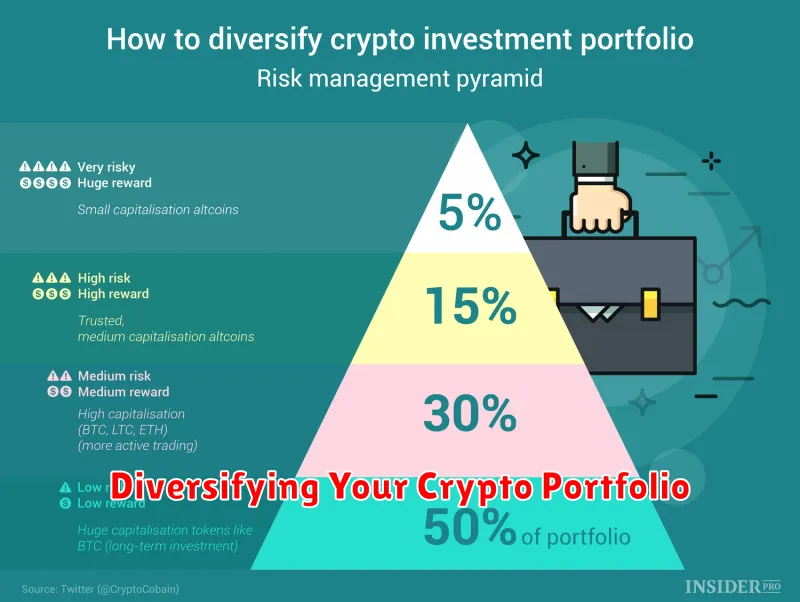

Diversifying Your Crypto Portfolio

Diversification is a crucial aspect of risk management in any investment portfolio, and the cryptocurrency market is no exception. A diversified portfolio can help mitigate potential losses associated with the inherent volatility of individual cryptocurrencies.

Diversification strategies involve spreading investments across various assets to reduce the impact of any single asset’s underperformance. In the crypto space, this translates to investing in a range of cryptocurrencies with differing characteristics, market capitalizations, and functionalities. This reduces the overall risk by lessening reliance on the success of a single project.

Consider diversifying across different asset classes within the crypto market. This might include investing in a mix of Bitcoin (BTC) and Ethereum (ETH) – often considered the market leaders – alongside smaller-cap altcoins with promising projects. The allocation should depend on your individual risk tolerance and investment goals.

It’s vital to conduct thorough research before investing in any cryptocurrency. Understanding the technology behind each project, its team, and its market position is paramount. Avoid investing in projects based solely on hype or social media trends.

Asset allocation is another important consideration. There’s no one-size-fits-all answer; the optimal allocation depends on factors such as your financial goals, risk appetite, and investment timeframe. However, it’s generally advisable to avoid over-concentrating your portfolio in any single cryptocurrency, no matter how promising it might seem.

Regularly rebalancing your portfolio is also crucial. As the market fluctuates, the proportion of each asset in your portfolio can shift. Rebalancing ensures that your original asset allocation remains aligned with your investment strategy. This helps to capitalize on gains and limit potential losses.

Finally, remember that cryptocurrency investments are inherently risky. The market can experience significant volatility, and the value of your holdings can fluctuate dramatically. Diversification is a crucial strategy to mitigate risk, but it does not eliminate it entirely.

Understanding Market Trends and Cycles

Market trends and cycles are crucial concepts for investors and businesses alike. Understanding these patterns can significantly impact decision-making, allowing for better risk management and potentially higher returns.

Trends refer to the general direction of a market over a period of time. These can be uptrends (bull markets), characterized by rising prices and optimism, or downtrends (bear markets), marked by falling prices and pessimism. Identifying the prevailing trend is a fundamental step in any market analysis.

Market cycles, on the other hand, refer to the recurring patterns of expansion and contraction within a market. These cycles are often influenced by various factors, including economic conditions, technological advancements, and investor sentiment. Recognizing these cycles can be beneficial for timing investments and mitigating potential losses.

Several key indicators help in understanding market trends and cycles. These include economic data (GDP growth, inflation, unemployment), consumer confidence indices, and various technical indicators used by market analysts. Analyzing these indicators can provide insights into the current market phase and potential future direction.

It’s important to note that market trends and cycles are not perfectly predictable. While understanding these patterns can improve investment strategies, no method guarantees success. External factors and unforeseen events can significantly impact market behavior. Therefore, a diversified approach and careful risk assessment are essential.

Fundamental analysis and technical analysis are two common approaches used to analyze market trends and cycles. Fundamental analysis focuses on underlying economic factors, while technical analysis uses price charts and historical data to identify patterns and predict future price movements.

Ultimately, understanding market trends and cycles requires continuous learning and adaptation. Staying informed about current events and economic indicators, coupled with a thorough understanding of analytical tools, will greatly enhance your ability to navigate the complexities of the market.