Decentralized Finance (DeFi) is revolutionizing the financial landscape, offering a compelling alternative to traditional financial systems. This article explores five key benefits of DeFi, highlighting its potential to increase financial inclusion, enhance transparency, improve efficiency, and foster innovation in the global financial ecosystem. Discover how DeFi empowers individuals with greater control over their finances and unlocks new opportunities through blockchain technology.

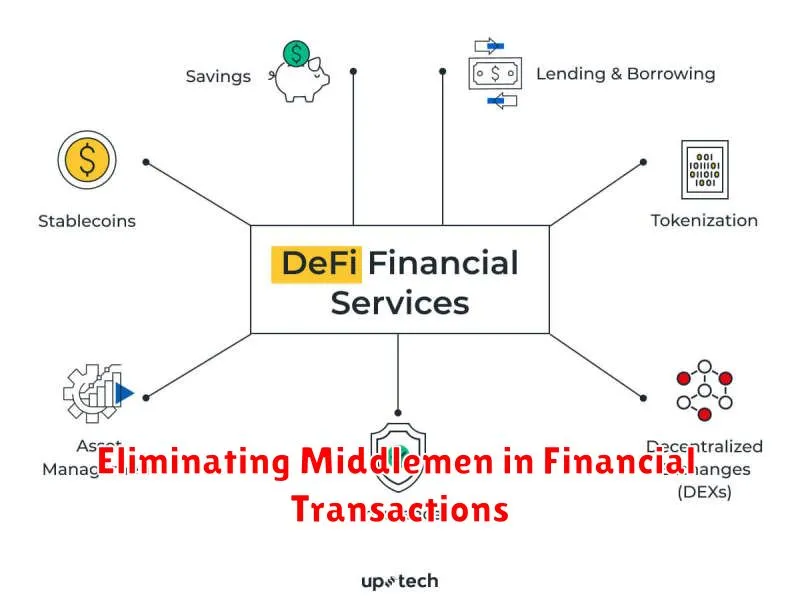

Eliminating Middlemen in Financial Transactions

The concept of disintermediation, or eliminating intermediaries in financial transactions, is gaining significant traction. Traditional financial systems often involve multiple intermediaries, such as banks, brokers, and clearinghouses, each adding costs and layers of complexity.

Blockchain technology is a key driver in this shift. Its decentralized and transparent nature allows for peer-to-peer transactions without the need for a central authority. This directly reduces transaction fees and processing times, offering significant cost savings for both individuals and businesses.

However, eliminating middlemen presents certain challenges. Concerns regarding security, regulatory compliance, and the potential for increased fraud need careful consideration. Robust security protocols and clear regulatory frameworks are crucial to ensure the safety and reliability of disintermediated financial systems.

Furthermore, the adoption rate of disintermediation technologies varies significantly. While certain sectors, such as cryptocurrency trading, have embraced these technologies, widespread adoption across all financial sectors requires significant technological advancements and changes in consumer behavior.

In conclusion, while the elimination of middlemen in financial transactions offers substantial benefits, such as reduced costs and increased efficiency, it also necessitates addressing key challenges related to security, regulation, and technological adoption. The future of finance will likely involve a dynamic interplay between traditional systems and disintermediated models, leading to a more efficient and potentially more inclusive financial ecosystem.

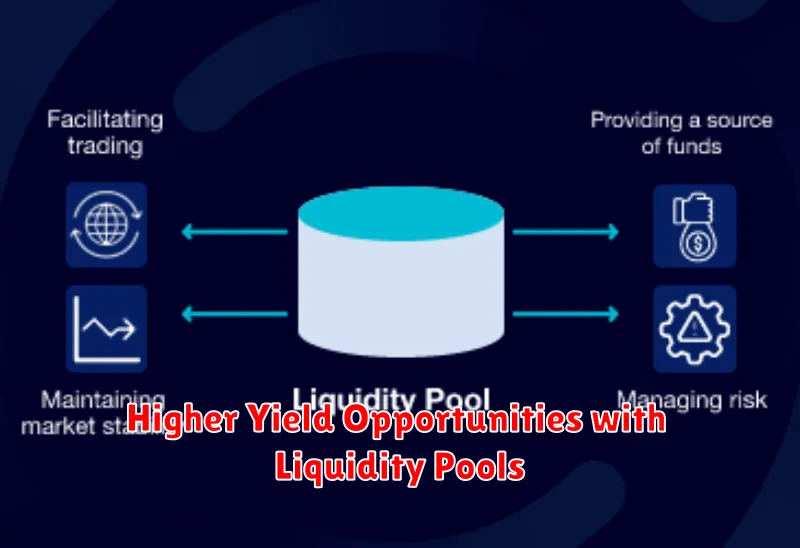

Higher Yield Opportunities with Liquidity Pools

Liquidity pools offer a compelling avenue for investors seeking higher yields than traditional savings accounts or bonds. These pools, integral to decentralized finance (DeFi), function by matching buyers and sellers of cryptocurrencies, facilitating efficient trading.

By providing liquidity to these pools, users earn rewards in the form of trading fees and, often, a share of the pool’s underlying assets. The yields generated can significantly exceed those offered by conventional financial instruments, creating an attractive proposition for those willing to accept the associated risks.

However, it’s crucial to understand the inherent risks involved. Impermanent loss, a phenomenon where the value of deposited assets declines relative to holding them individually, is a primary concern. Furthermore, the volatility of cryptocurrency markets can dramatically impact returns, potentially leading to substantial losses. Smart contract vulnerabilities and the overall security of the platform hosting the liquidity pool also present significant risks.

Careful due diligence is paramount before participating in a liquidity pool. Thoroughly researching the specific pool, understanding its mechanics, and assessing the reputation and security of the platform are crucial steps. Diversification across multiple pools and assets can help mitigate some of the inherent risks. Only invest capital you can afford to lose.

Ultimately, liquidity pools represent a potentially lucrative opportunity for yield-seeking investors, but careful consideration of the risks and rewards is absolutely essential. A thorough understanding of the underlying mechanisms and a conservative approach to capital allocation are crucial for success in this dynamic and evolving landscape.

Accessibility to Banking Services Without Borders

The increasing globalization of finance necessitates a critical examination of accessibility to banking services across international boundaries. Individuals and businesses alike require seamless and efficient access to financial tools regardless of geographical location.

Technological advancements, such as mobile banking and online platforms, have significantly broadened the reach of banking services. However, challenges remain in ensuring equitable access for all populations, particularly in underserved or developing regions.

Regulatory hurdles pose a significant obstacle. Differing national regulations and compliance requirements create complexities for both financial institutions and their customers engaging in cross-border transactions. Harmonization of regulations, while a complex undertaking, is crucial for fostering greater accessibility.

Infrastructure limitations also play a crucial role. Reliable internet connectivity and robust technological infrastructure are essential for accessing online banking services. The digital divide continues to disproportionately impact individuals in remote areas, highlighting the need for investment in infrastructure development.

Furthermore, the issue of financial literacy must be addressed. A lack of understanding of financial products and services can hinder access, even when resources are technically available. Educational initiatives and awareness campaigns can empower individuals to navigate the financial landscape more effectively.

In conclusion, enhancing cross-border accessibility to banking services requires a multifaceted approach. It involves collaborative efforts from governments, financial institutions, and technology providers to overcome regulatory, infrastructural, and educational barriers, ultimately fostering greater financial inclusion on a global scale.

Smart Contracts for Trustless Agreements

Smart contracts represent a revolutionary approach to contract enforcement, leveraging blockchain technology to create trustless and self-executing agreements. Unlike traditional contracts that rely on intermediaries and legal systems for enforcement, smart contracts automate the execution of contractual obligations upon the fulfillment of predefined conditions.

The core functionality of a smart contract resides in its immutable nature, recorded on a decentralized and transparent ledger. This inherent characteristic eliminates the need for a trusted third party, reducing the risk of fraud and disputes. Once deployed, the terms of the contract are fixed and automatically enforced by the underlying blockchain network, ensuring transparency and predictability.

Key benefits of utilizing smart contracts include increased efficiency, reduced costs associated with intermediaries, and enhanced security through cryptographic verification. The automation eliminates delays and ambiguities often associated with traditional contract execution. The transparent nature of the blockchain provides auditable records of all transactions, fostering greater trust and accountability among parties.

However, the development and implementation of smart contracts require careful consideration. Security vulnerabilities in the code can lead to significant financial losses or contract breaches. Furthermore, the legal framework surrounding smart contracts is still evolving, requiring a clear understanding of jurisdiction and enforceability. Thorough testing and legal review are crucial stages in the smart contract lifecycle.

Despite the challenges, smart contracts hold immense potential for transforming various industries. Applications range from supply chain management and finance to healthcare and digital identity. As the technology matures and legal frameworks adapt, the adoption of smart contracts is expected to significantly impact the way agreements are structured and executed, fostering a new era of decentralized trust.

Reduced Costs and Faster Settlements

Implementing a streamlined claims process can significantly reduce costs associated with handling insurance claims. Automation and digital tools can minimize manual labor, reducing the need for extensive staffing and associated expenses like salaries and benefits. This efficiency translates directly into lower operational costs for the insurer.

Furthermore, a well-designed system accelerates claim settlements. Faster processing times mean quicker reimbursements for policyholders, increasing customer satisfaction and loyalty. Reduced processing time also minimizes the risk of disputes and potentially costly litigation, leading to significant cost savings in the long run.

The benefits extend beyond simple monetary savings. Faster settlements improve the insurer’s overall efficiency and reputation. Efficient claim handling allows insurers to allocate resources more effectively, focusing on preventative measures and proactive risk management rather than reacting to existing claims. This ultimately contributes to a healthier and more sustainable business model.

In conclusion, a focused effort on optimizing the claims process yields substantial returns, achieving both reduced operational costs and dramatically faster claim settlements. This creates a win-win scenario – improved financial performance for the insurer and enhanced satisfaction for policyholders.